Overview

The Request a payment section is a feature on our Blink platform that allows you to send PayLinks payment links to your customers and track Requested payments.

PayLinks payment links are unique one-use payment pages you can send to a customer via SMS or email to make a payment. Unlike the Take a payment feature, customers can pay via card, open banking, or Direct Debit.

These payLinks payment links are tracked to see if and how your customer has interacted with the PayLinkpayment link.

Navigation

Find Request a payment under the Payments tab on the left-hand navigation bar (Payments → Request a payment).

How does it work?

Request A Payment

First, select which MID you want to take the payment for. Select the type of transaction from the drop-down menu listing: Sale, Pre-Auth Card, and Verify.

| Info |

|---|

|

| Expand | ||

|---|---|---|

| ||

Payment type

Once you have selected the type of transaction, you have the option of 3 payments types, depending on the payment rails you have set up on your account:

Card payment

Direct Debit

Open banking

You can choose your customer's payment options by selecting one or multiple methods above while creating the PayLinkpayment link.

Customer details

Next, enter the" button, where it will ask for the email/phone number to send the PayLink payment link request.

Reminders

Automatically remind your customer of an unpaid request.

| Expand | ||

|---|---|---|

| ||

Request a Payment reminder. Remind your customers automatically on outstanding PayLinkspayment links. How does it work? Choose to send payment reminders for unpaid paylinks payment links automatically. You can enable reminders for individual payments while creating the PayLink payment link or for all new payment requests as a blanket rule. Reminders can be switched on for all payment requests (only for new requests) or manually selected.

You can switch reminders on/off on individual requests. When does Blink send a reminder? You can choose how often you want to remind the customer during setup. If the customer has not paid by the date set on the requested payment reminder, the system will automatically send them a reminder at 12:00 PM (GMT/BST) on that day. The reminder email will be the same as the initial email. You can easily track the reminders sent on the Requested payment page. User access All users, except Payment Tier 2 (user-level) can create paylinks payment links with reminders. Adjusting payment request reminders There is an option to turn off reminders or edit the schedule for a specific payment request on the Requested Payments page. The clock icon indicates a reminder is set for this link. Clicking on the clock displays a pop-up where you can adjust the reminder schedule or turn off reminders by toggling "Remind Customer Off.” Create a blanket rule for all paylinkspayment links You can make an overall decision to send reminders to all new PayLinks payment links on the Payment preferences page (Under Payment Operations). This can be switched off for individual PayLinks payment links during the creation of a new payment or once the paylink payment link has been sent. |

Expiry date

Choose an expiry date for your paylinkpayment link.

Send - Sends the PayLink payment link request to the specified email/phone number.

| Expand | ||

|---|---|---|

| ||

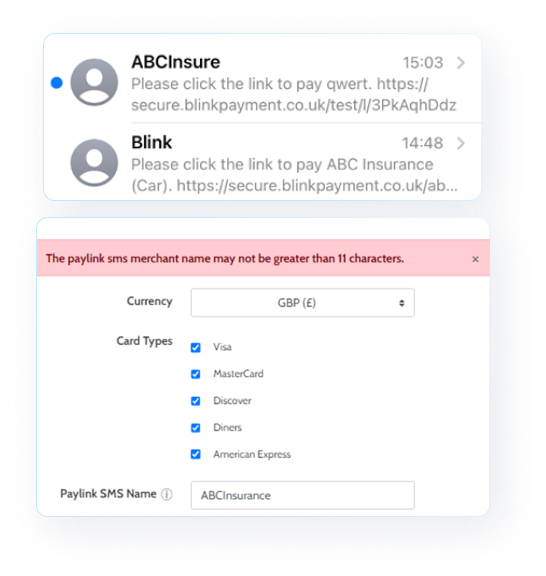

The customer will receive a text message from BLINK, with the link in the message. If you want to change the contact name to something else, head to your Merchant shop settings in the Blink Page Customiser and add your contact name to the PayLink payment link SMS Name input.

|

When a PayLink payment link has been successfully processed, the merchant and customer will receive their receipts.

| Info |

|---|

When you set up a merchant account with us, you are asked which currencies to use to process transactions. You can request additional currencies to be added. (Applicable only with card payments and open banking). |

Tracking & Reporting

Find out how you can track your PayLinks payment links in the Requested payments tab; Within the Reporting section, you can find an overview of the transactions within the different payment methods.

Payments Specifics

Direct Debit specifics

Find out more about Direct Debit.

| Info |

|---|

To use Direct Debit within the Request a payment feature, you need a GoCardless account. Once you have set this up, you can take payment and set up a mandate with your customer. |

Creating/Connecting your GoCardless account

Navigate to the Direct Debits area by selecting the dashboard icon or using the left-hand navigation bar (Customer centre→ Manage Direct Debits).

You will now be asked to select from a Live or Test account, log in to your existing GoCardless account, or create a new one. This will take you to a page hosted by GoCardless to enter the relevant information.

Open banking specifics

Find out more about Open Banking.

You can request the Open Banking feature with our Blink Support Team.

Once requested, you will be onboarded by a Blink support team member; after this has been completed, your customers can pay you using open banking.